Six Month Sabbatical Budget Review

I've spent the last six months putting my sabbatical budget plan to the test in my own sabbatical. I haven't gone broke yet 😅

Table of Contents

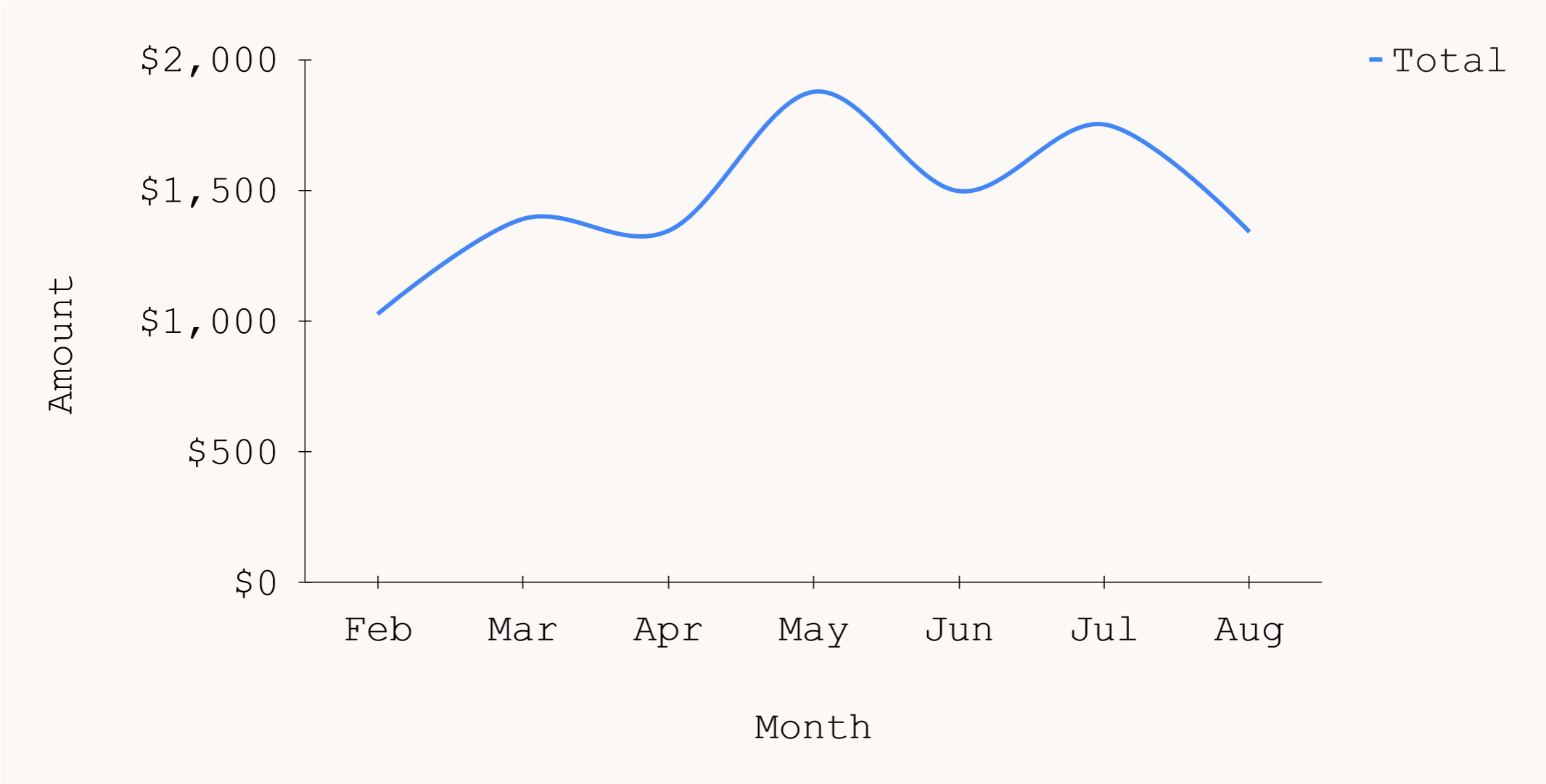

Expenses by month

I spent a total of $10,229 in six months, averaging $1,705 per month. My monthly costs have been as low as $1,027 and as high as $1,877.

Forecasting this out to a full year, I expect my annual expenses to be about $20,458; this is 16% more than my forecast of $17,700.

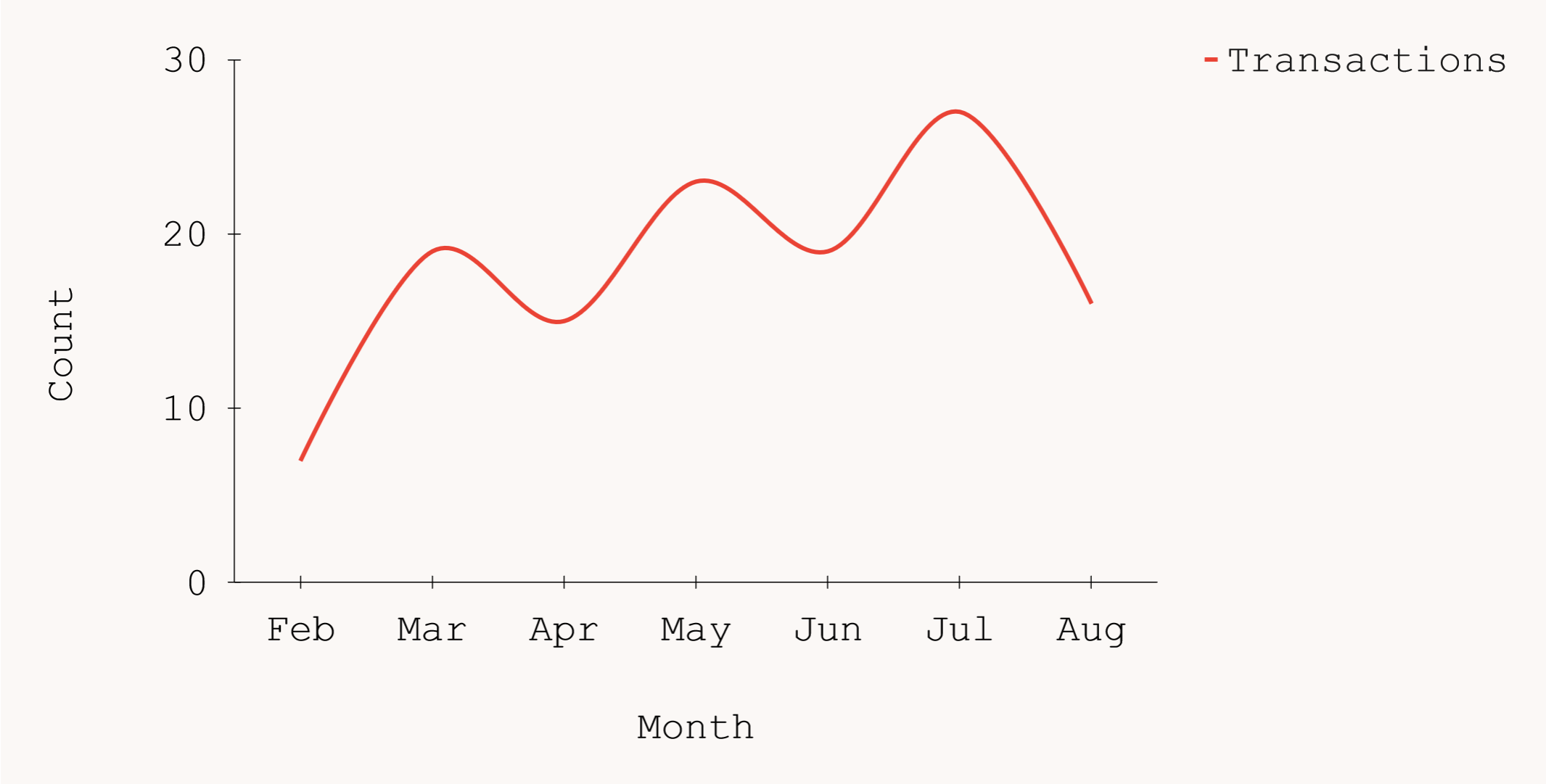

I bought things 126 times, with the most transactions completed in July.

Caveats

These expenses are undercounted for a few reasons:

- I share costs with my girlfriend (mostly restaurants) that have not been balanced yet.

- I already own most of the hard-goods for my hobbies—headphones, speakers, bike parts, etc.

- My big travel expenses are flights around the holidays, which aren't reflected in this period.

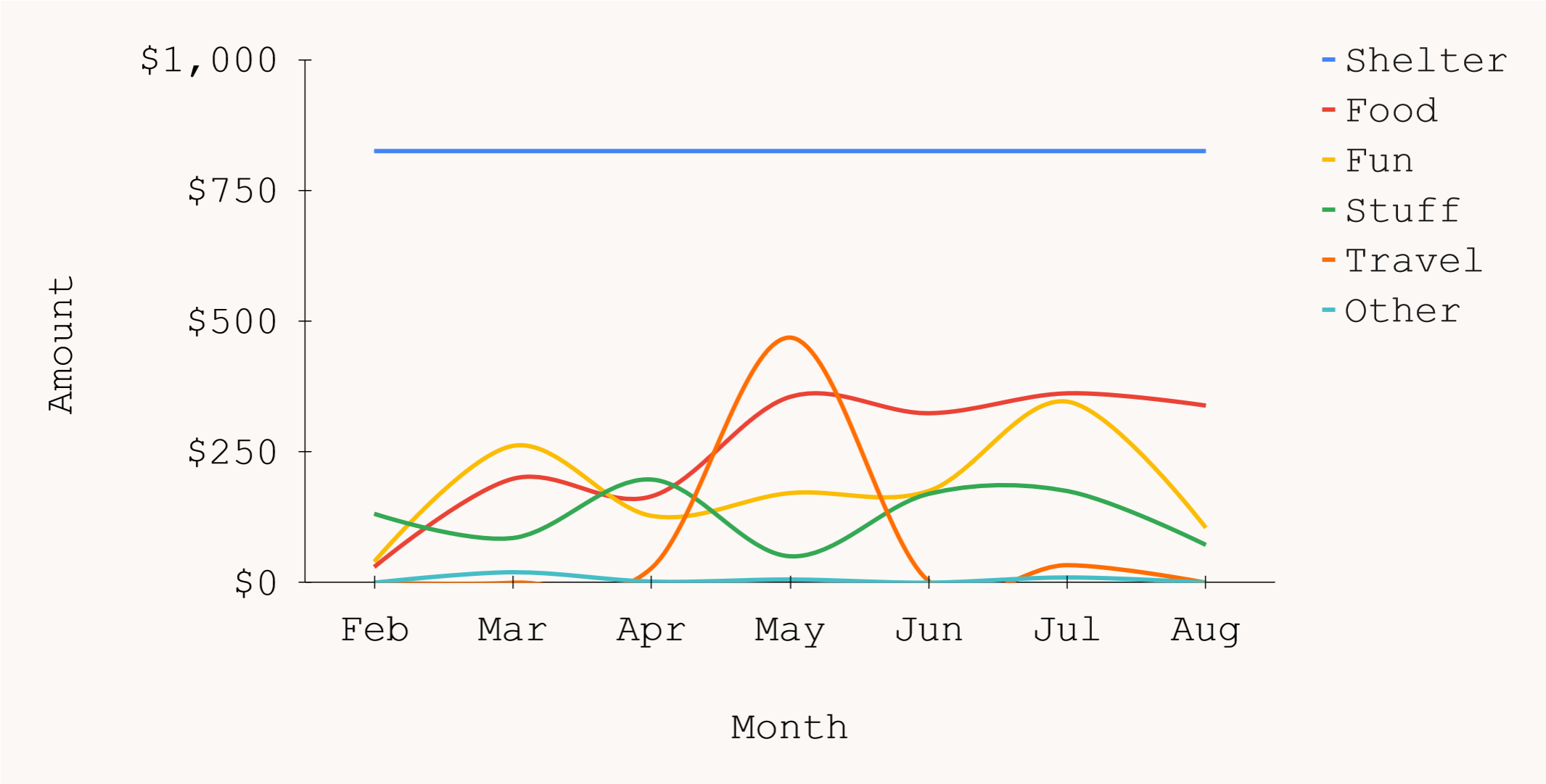

Expenses by category

Breaking expenses out by category shows how discretionary and non-discretionary spending contribute to my total expenses.

- Shelter (in the form of rent) is my largest cost by far, accounting for 57% of my total expenses. This cost is mostly non-discretionary; reducing it would require serious lifestyle changes.

- Most categories from my initial budget were relatively accurate. I exceeded my budget on restaurants (a component of "Food") and general merchandise ("Stuff"). Reducing costs here is possible and a matter of better planning and self control, but the overage was small so I'm not too concerned about it.

- One thing that stands out from this graph is a category that is missing: healthcare, because I'm on Medicaid. Some incidental medical expenses are included in "Other".

Income

Although I wasn't working full-time, I made some money through odd jobs, investments, and refunds.

| Source | Amount |

| CO TABOR Refund | $750 |

| Fundrise Dividends | $536 |

| Homestead Animal Care | $100 |

| Yellow Barn Ditch Cleaning | $72 |

| COOL Boulder Data Collection | $45 |

| Total | $1,503 |

Interpreting the data

- My housing costs are well below the average for my area, so it makes sense to continue to rent here as long as possible.

- Colorado Medicaid has saved me a lot compared to COBRA or marketplace plans—on the order of several hundred dollars per month.

- I've been able to take advantage of lots of free opportunities (Free Days at the Denver Art Museum, Denver Botanic Gardens Free Days, etc.) because of my schedule, which has helped keep "Fun" expenses down, although driving more increased my "Travel" expenses.

- Odd jobs are fun but don't cover my costs (yet). I'll start pursuing part-time work in the coming months with the goal of breaking even.

- Opportunity cost: I would have made approximately $40,000 during the last six months if I had continued working, plus the future value of retirement contributions. I don't think this is a useful way to think about sabbaticals but it sometimes comes up in discussions.

How I analyzed the data

- Export statement CSV from CapitalOne.

- Clean shared/irrelevant items.

- Manually review items and categorize.

- Add in other items that are missing from credit report (rent, streaming services).

- Create pivot table to show expenses by category by month.

- Graph total and category expenses.

- If you'd like to look behind the scenes here's my source data.