How Much Money Do You Need To Take A Sabbatical?

“Can I afford to take a break?”

“How will I pay my bills if I’m not working?”

“How much money do I need to take the time away from work I need?”

“What if there’s an emergency?”

These were some of the questions I asked myself when I started thinking about leaving my job to take a sabbatical, and you may find yourself asking similar questions. While there are numerous guides and resources for creating and maintaining a budget while you are working, there aren’t many that answer the question of how much money you need to leave that steady stream of income behind.

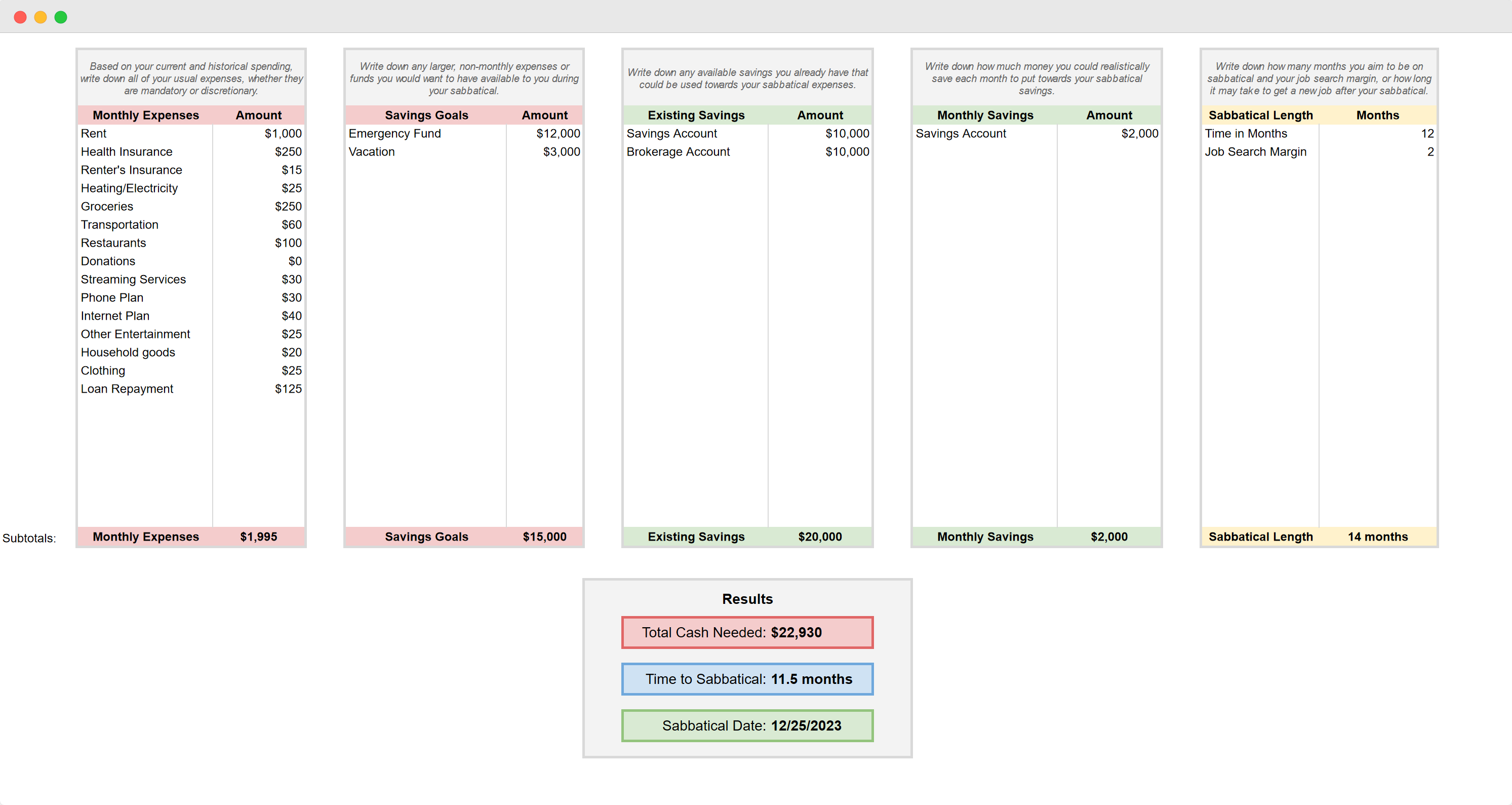

To answer this question for my own sabbatical, I made a spreadsheet to help me plan. Now, I’m sharing the Sabbatical Budget Worksheet so you can put together a personalized plan for your own sabbatical!

See the results of my planning in the Six Month Sabbatical Budget Review.

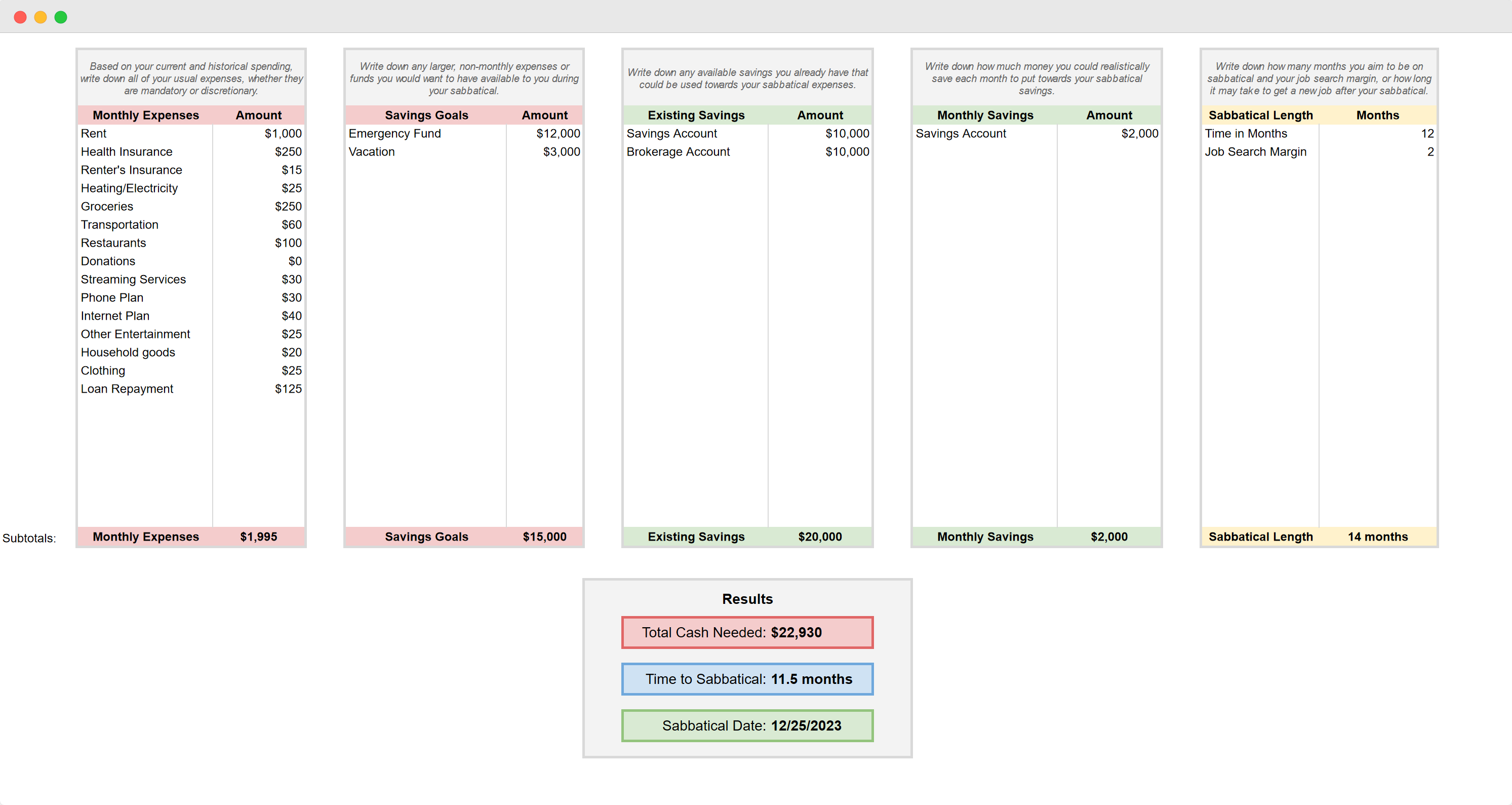

This worksheet uses a few details about your current and future financial situation:

- Monthly expenses

- Savings goals

- Existing savings

- Monthly savings

- Sabbatical length

By modeling your assets (savings) and liabilities (expenses), you can estimate how much money you’ll need to cover your sabbatical and how much longer you'll need to work in order to reach your savings goal.

A sabbatical should be a time of rest and exploration, and it’s harder to do this effectively if you’re worrying about money. Putting together a budget will increase your confidence that you have enough money to leave your current employment and live off your savings for an extended period of time.

This process is most useful if you are self-funding your sabbatical. If you are taking an employer-funded sabbatical, your existing budget is likely sufficient but it might still be interesting to go through to see if you’re on track.

If that sounds useful, let’s get started!

Try it yourself.

I’m actively working on the worksheet and its instructions so please let me know if you have any questions, comments, or suggestions.

How To Fill Out The Worksheet.

Step 1: Know Your Expenses.

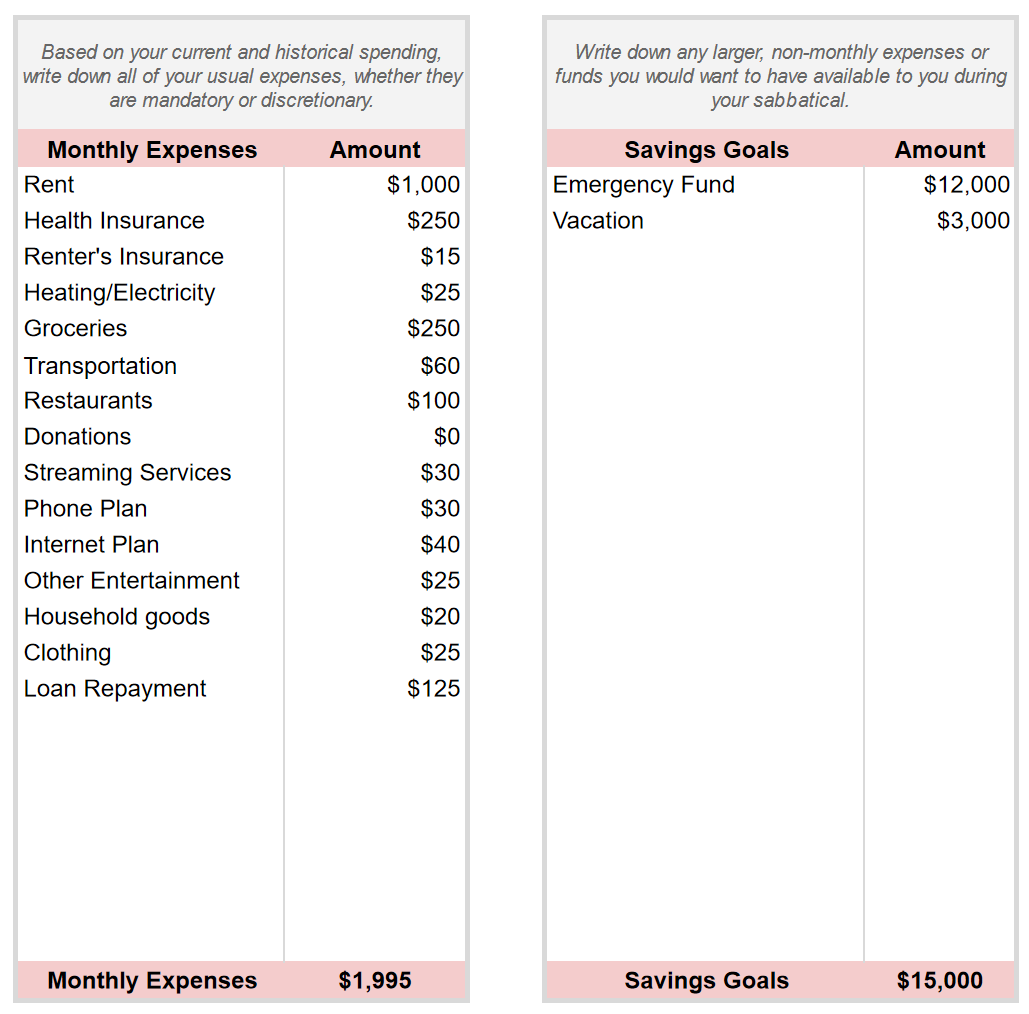

The amount of money you’ll need to take a sabbatical is determined by your monthly expenses and any other savings goals you’d like to achieve before leaving your job.

Monthly Expenses.

Monthly expenses are expenses you can calculate based on your current and historical spending habits.

Look at your bank statements for the past 3-6 months. There are likely some static expenses—like rent, mortgage, bills, insurance, subscriptions—that don't change much month-to-month. Then there are expenses that may vary significantly each month, which you can average out by looking back at your historical spending. These can include groceries, eating at restaurants, travel, and entertainment.

A faster way to estimate this amount is to simply average your monthly spending for the last six or twelve months and use that as your “Monthly Expenses” value. However, the process of reviewing your actual monthly expenses is useful for finding opportunities to save money.

Take your time on this step and be honest with yourself. You may have non-negotiable and negotiable expenses under both static and variable expenses. Include them all in this step by adding, modifying, and removing as many rows as you need so that it reflects your current monthly expenses. Later in the process, you'll have the opportunity to look for ways to potentially cut spending depending on your priorities.

The basic cost of a sabbatical is your monthly spending multiplied by your sabbatical length in months:

Sabbatical Cost = Spending Rate During Sabbatical x Sabbatical LengthFor example, if you want to take a 12 month sabbatical and your cost of living is $3,000 per month, it will cost $36,000 to take a sabbatical:

12 months x $3,000/month = $36,000Although the basic calculation is simple, there are some additional factors that may change how much longer you’ll need to work including existing savings and debts. We'll add those into our model next.

One-Off Savings Goals.

Your one-off savings goals should be larger buckets of expenses that you may or may not need to use during your sabbatical but that you want to save for just-in-case.

One example of this kind of goal is starting or increasing an emergency fund for unplanned expenses. Having an emergency fund is important and recommended for everyone considering a sabbatical. However, your emergency fund goal will vary depending on your situation, the amount of time you plan to take for your sabbatical, and your personal comfort level.

A general recommendation for an emergency fund is 6-12 months of expenses; I use 6 months as my personal guideline but your risk tolerance and personal circumstances may suggest a different amount. A larger emergency fund offers more security but will take longer to save for.

A note on using emergency funds: If you already have an emergency fund, you could use some or all of it to pay for your sabbatical. Because you may still have emergency expenses during your sabbatical, I’d only recommend doing this if you consider your working situation an emergency and want to take a sabbatical as soon as possible.

Other one-off savings goals may be a bucket fund for vacations or entertainment. Something you’d like to be able to draw from, but doesn’t quite fit into regular monthly expenses.

Only include savings goals that would apply during the length of your sabbatical. If you were planning to save up for a large purchase (home down payment, college fund, etc.), but you’re putting that on hold in favor of a sabbatical, don’t include it in the worksheet.

Handling Debt.

I didn’t include a separate column for debt (mortgage, student loans, car payments, etc.), but there are two different ways to include debts in the worksheet:

- If you make a monthly payment towards your debt, include it in the “Monthly Expenses” section.

- If you’d like to represent the debt as a lump sum, enter it in the “One-Off Savings Goals” section.

Step 2: Know Your Assets.

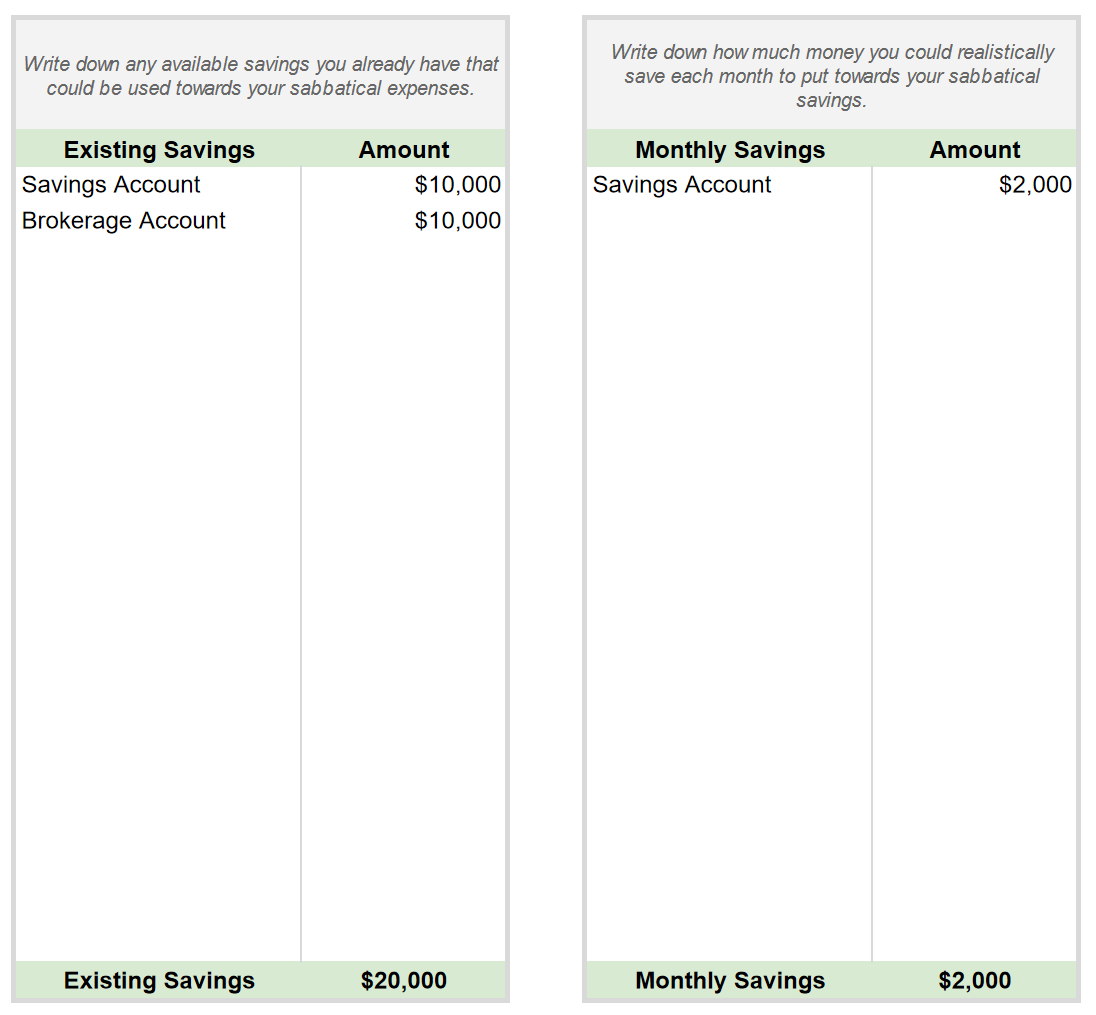

Once you’ve established your current monthly expenses and other one-off savings goals, it’s time to look at your existing savings and calculate how much you can start saving each month towards your sabbatical.

Existing Savings.

Throughout your career, you may have begun putting parts of your paycheck into savings and brokerage accounts. Perhaps you were saving up for a particular purchase or creating an emergency fund. Wherever you are on that journey, it’s time to look at what funds you have available and determine what you could use to support a sabbatical.

Gathering the data for this step may not take much time, but it’s important to consider what savings you wouldn’t mind dipping into versus the savings that you would. For instance, I have retirement savings, which if utilized would allow me to take a significantly long sabbatical, but it wouldn’t make sense for me to take from those funds now. However, I’ve also been putting money into a brokerage account for some time as a general savings fund with no specific goal or purchases in mind. While I wouldn’t put my retirement savings into the worksheet, I would put my brokerage account funds.

The other important consideration is the availability and fluctuations inherent in a particular form of savings. If your savings are in a savings account, you likely have near-immediate access to your money when you need it and there’s no fluctuation in the value of that account (inflation notwithstanding). Alternatively, you may have stocks or options in a brokerage account which fluctuates in value. If you’re planning to use these assets to fund your sabbatical, you may be forced to sell when those positions are down. Consider reducing this volatility by selling these positions for cash or accept that the future account value may not equal the current account value.

Monthly Savings.

Monthly savings is the biggest factor in how much longer you will need to work in order to fund your sabbatical. Ask yourself how much you can realistically put into a sabbatical savings account each month and enter that number in this section. If you plan on splitting your savings across different accounts, feel free to put those as two separate rows.

Similar to the distinction between retirement savings versus general savings, don’t include any savings here that aren’t directly meant to cover your expenses during your sabbatical.

Step 3: Determine the Time You Need.

Sabbatical Length.

The answer here is entirely up to you and will vary significantly from one person to the next. There is no one size fits all, but it may be helpful to start by thinking about any internal and external influences on your sabbatical length.

The biggest internal influence is your reason for considering a sabbatical in the first place. Are you taking a sabbatical to:

- Take a break and recover from burnout?

- Step back and figure out what you want to do next?

- Switch careers?

- Travel and explore the world?

- Explore a new hobby?

- Spend more time with your family or friends?

Other internal influences may include factors like your ability to create your own structure or your tolerance for keeping yourself entertained.

External influences come from the people and environment around you. Are you a caretaker? Do you have a partner with whom you share expenses? Does your field have specific hiring cycles that you would need to adhere to?

Whatever answer you come to at this time, write down the number of months specifically for your sabbatical. For recovering, learning, exploring, or anything else you need or want to do.

If you need some direction, the most common sabbatical length is twelve months.

Then think about your job search margin, or the time you would spend looking for a new job. For some people in a high-demand or more flexible position, you may not feel you need more than a month or two to find a new job. For people who are switching careers or know the interview process in their field takes a while, your margin may be several months.

By thinking about your sabbatical time and job search time separately, you can preserve your sabbatical time for rest and exploration by reserving planned time for transitioning into the next phase of your life.

Step 4: Evaluate the Results.

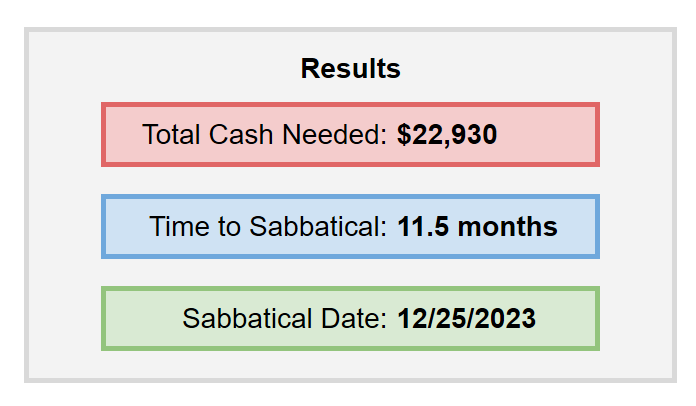

After completing the first three steps, you should now see your results, which include:

- Your total cash needs based on your expenses, current savings, and sabbatical length.

- Your time to sabbatical, based on your total cash needs and monthly savings rate.

- The date you can take your sabbatical, calculated by adding your time to sabbatical to today’s date.

If you’ve made it to this point, congratulations! You’ve now answered the questions “How much money do I need to take a sabbatical?” and “How much longer will I need to work so that I have enough savings to take a sabbatical?”

You could leave it there if you wanted to. You can now take that sabbatical date, mark it on your calendar, and celebrate that you’re one step closer to taking a sabbatical. You’ve earned it!

However, I’d suggest going through a few bonus steps to really solidify and maintain your plan. After taking a moment to celebrate, of course 🙂

Bonus Planning Steps.

Reflect On Your Outputs.

First, take some time to reflect by asking yourself:

- What is your reaction to the worksheet outputs?

- Are you excited that you’ll be able to take a sabbatical soon?

- Are you disappointed that it will take longer to save for a sabbatical than you hoped?

Adjust Your Inputs.

If you are disappointed with your time to sabbatical (or simply want to accelerate your time to sabbatical), you can play around with your inputs to see how they change your outputs. How does your sabbatical date change if you:

- Increase your savings rate?

- Decrease your monthly spending?

- Change other savings goals?

By changing your numbers and seeing the new results, you may decide to adjust your original inputs.

For example, while your monthly expenses are based on your current spending habits, you may know that, by taking a sabbatical, you can cut down certain expenses automatically. If you’re paying for gas to commute to work every day, or paying for childcare while you’re at work, you may not have those expenses when you’re no longer working.

Other expenses may be more of a negotiation with yourself. If you spend a lot at restaurants, would you be able to cut that by cooking more at home? Or if you can cut some of your spending now, would that free up more of your income to put towards your monthly savings?

If your time to sabbatical is greater than one year, it may make sense to increase your savings rate by finding a new job with higher income instead of continuing at your current job.

As with the rest of this process, it is important to be honest with yourself. If cutting down your spending at restaurants simply doesn’t seem realistic for you, then don’t change that number. There are no right or wrong answers when filling out this worksheet, but by making these refinements you’ll have an even clearer answer to how much longer you’ll need to work before taking a sabbatical.

Update Your Plan.

As you begin saving and working towards your sabbatical, be sure to update the values as needed.

- Are you a few months in and now have $5,000 more savings? Update the Existing Savings.

- Did you receive a raise and can now save more each month? Increase your Monthly Savings.

- Do you have a new recurring payment? Add it to your Monthly Expenses.

Sabbatical Date will update automatically, allowing you to keep track of your progress as you approach your savings goals and are ready to take your sabbatical!

Please let me know if you use this worksheet for planning your sabbatical; I’d love to hear if it was useful or if you have feedback to make it more useful!

Many thanks to Kiersten Clingersmith and the editors at Foster for valuable feedback on the first version of this guide.